In the bustling world of financial markets, Standard Chartered has emerged as a leading player, offering investors a range of opportunities for stock trading in the United States. Whether you're a seasoned investor or a beginner looking to enter the market, understanding how to trade stocks with Standard Chartered is crucial. This guide will delve into the key aspects of Standard Chartered's stock trading platform, ensuring you have the knowledge to make informed decisions.

Understanding Standard Chartered's US Stock Trading Platform

Standard Chartered's US stock trading platform is designed to cater to a diverse range of investors. From basic stock purchases to more complex trading strategies, the platform offers a user-friendly interface and a suite of tools to help you navigate the stock market effectively.

Key Features of Standard Chartered's Stock Trading Platform:

User-Friendly Interface: The platform is designed to be intuitive, making it easy for both beginners and experienced traders to navigate.

Advanced Tools: Access to a variety of analytical tools and research resources to help inform your trading decisions.

Diverse Investment Options: The platform offers a wide range of stocks from different sectors and geographical locations, providing you with ample opportunities to diversify your portfolio.

Competitive Fees: Standard Chartered offers competitive fees, ensuring that your trading expenses are kept to a minimum.

Customer Support: A dedicated customer support team is available to assist you with any questions or concerns you may have.

Getting Started with Standard Chartered US Stock Trading

Before you start trading stocks with Standard Chartered, it's important to understand the basics. Here's a step-by-step guide to help you get started:

Open an Account: Visit the Standard Chartered website and sign up for an account. You'll need to provide some personal and financial information to complete the process.

Fund Your Account: Once your account is approved, you can fund it with the money you wish to trade.

Choose Your Investments: With your account funded, you can start researching and selecting the stocks you want to invest in.

Place Your Orders: Use the platform to place your stock orders. You can choose from various order types, including market orders, limit orders, and stop orders.

Monitor Your Investments: Keep an eye on your investments and make adjustments as needed to align with your investment goals.

Case Studies: Successful Trading Strategies with Standard Chartered

Several investors have successfully utilized Standard Chartered's stock trading platform to achieve their investment goals. Here are a few examples:

John D., a Beginner Investor: John began trading with Standard Chartered after completing an online trading course. By using the platform's research tools, he was able to identify undervalued stocks and make profitable investments.

Sarah M., an Experienced Trader: Sarah has been trading for years and chose Standard Chartered for its advanced analytical tools and competitive fees. She has been able to implement her complex trading strategies effectively, leading to consistent returns.

Mark T., a Diversified Investor: Mark used Standard Chartered's platform to diversify his portfolio across different sectors and geographical locations. This strategy helped him mitigate risk and achieve steady growth over time.

Conclusion

Standard Chartered's US stock trading platform offers a comprehensive suite of tools and resources to help you navigate the stock market successfully. Whether you're a beginner or an experienced investor, understanding how to utilize this platform can significantly enhance your investment strategy. By taking advantage of the platform's features and staying informed about market trends, you can make informed decisions and achieve your investment goals.

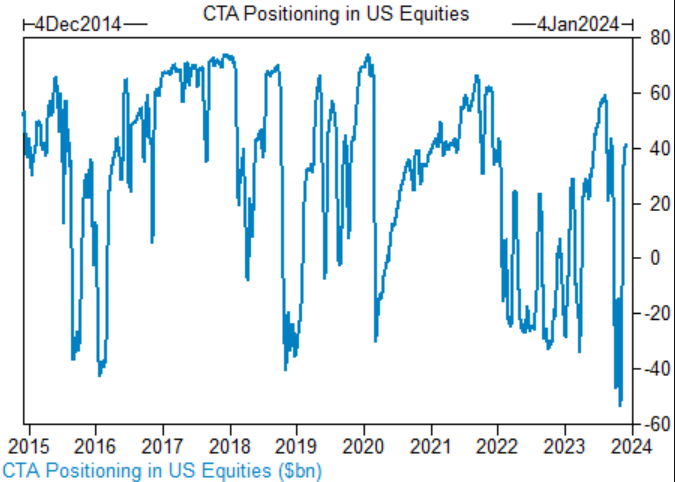

nasdaq composite